Our Mission

We founded Daintree Capital because we see a huge investment opportunity in funding founders who are often overlooked by traditional investors. If you believe talent is equally distributed regardless of race, gender or socio-economic status, then there is a significant opportunity to invest in founders who have not had access to investment capital.

We seek out founders from all backgrounds, with a focus on those who have been overlooked by traditional investors. We are working to build a world where investment capital flows to founders based on the strength of their ideas and the depth of their work ethnic, not based on the serendipity of their life circumstances.

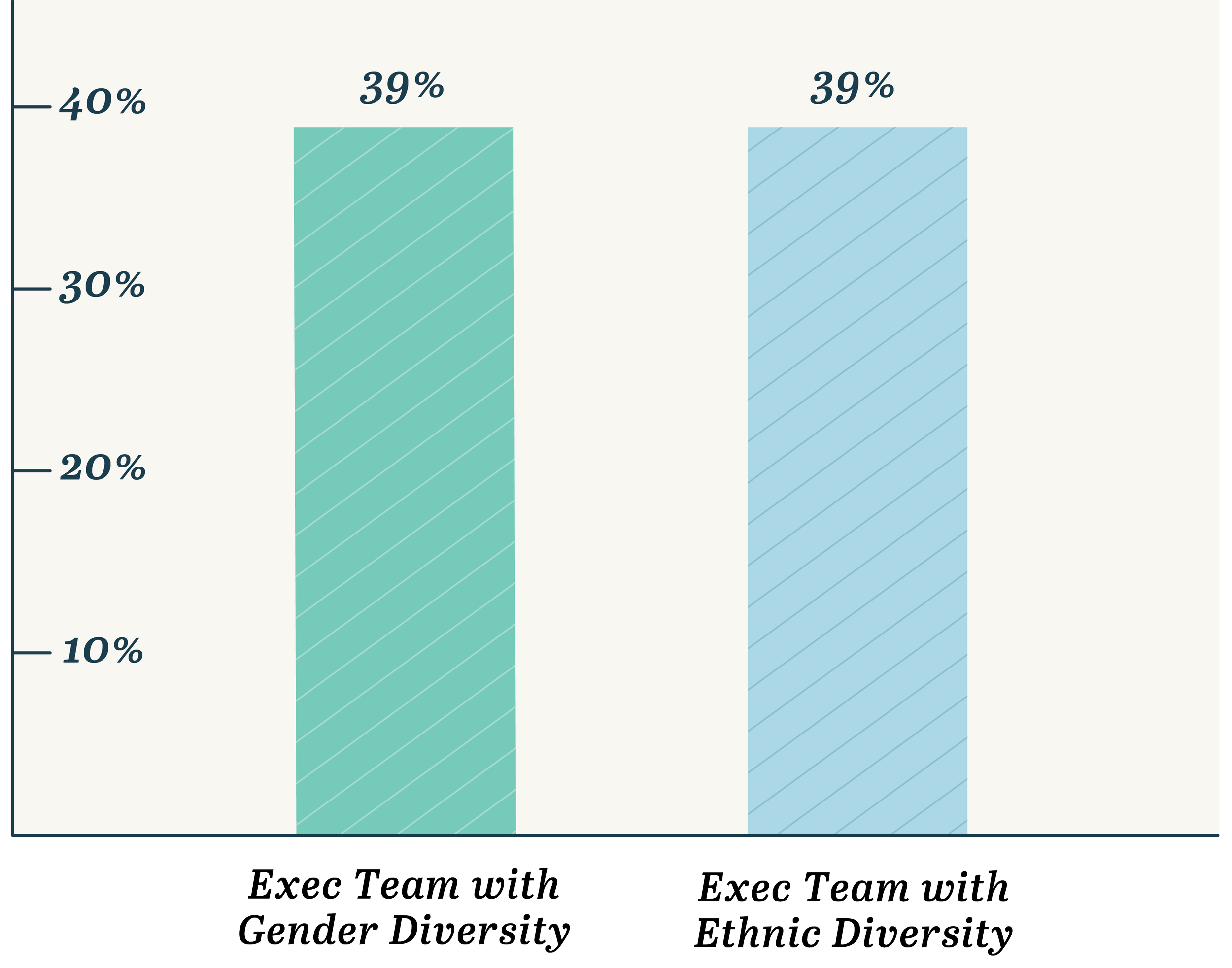

We invest in companies run by diverse teams because the data demonstrate these companies outperform.

Profitability Improvement

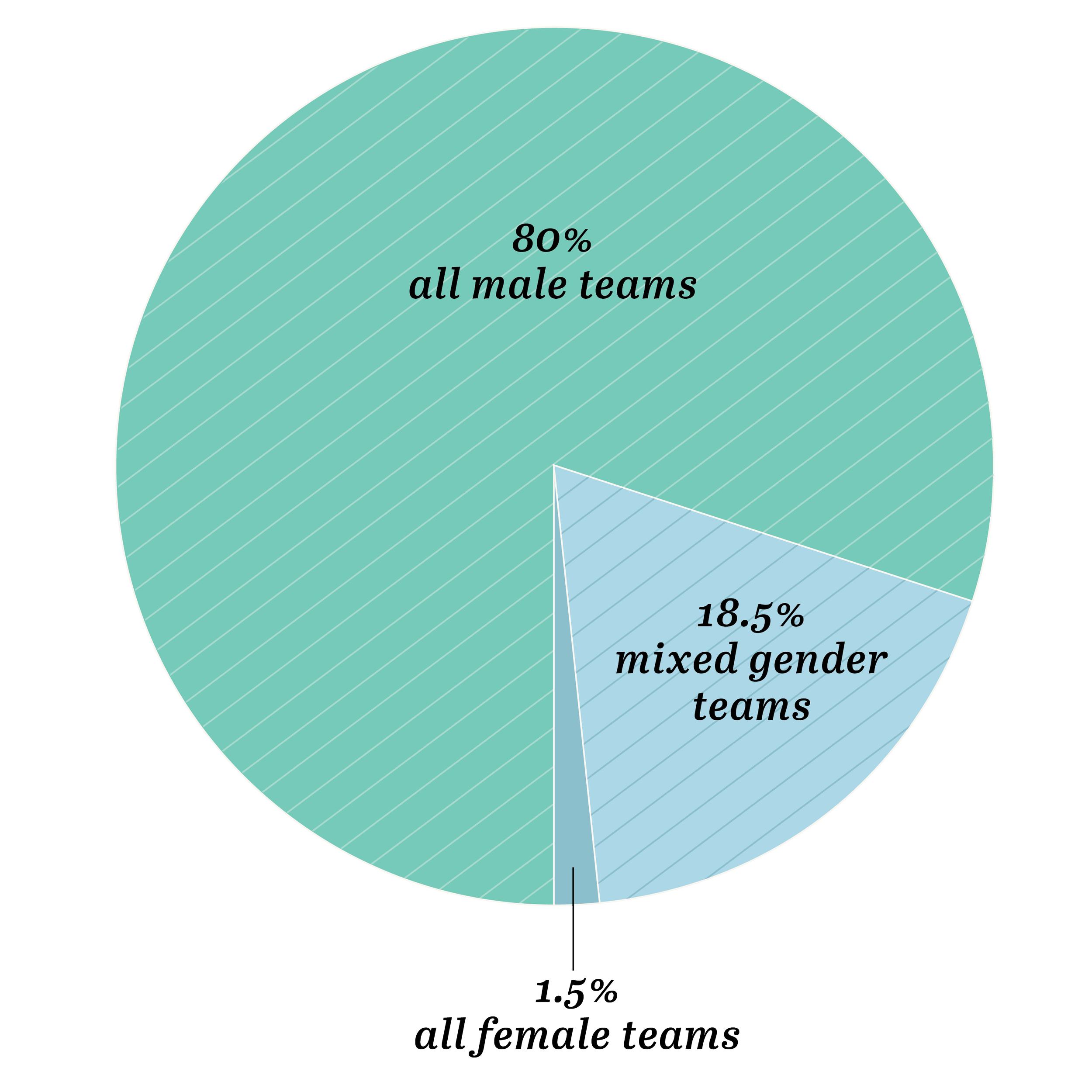

relative to gender/ethnically homogenous Exec TeamsDespite these improved outcomes, the vast majority of investment capital flows to all-male and all-white management teams

Share of Venture Capital Investment

This data suggest that either women have less than 2% of the best new business ideas or that the businesses they are building are significantly under-valued.

This is the investment opportunity upon which Daintree was founded.